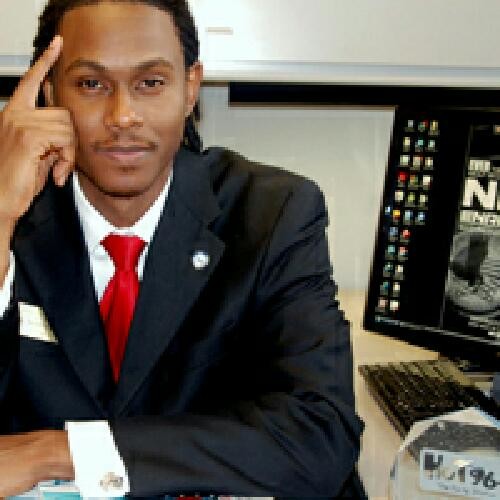

When Arlo Washington was just 17 years old, his mother passed away, and he took on the responsibility of caring for his younger siblings. He moved from Little Rock to New York City, where he began working as a fashion model and barber at the age of 19.

After some time, Washington decided to return to his hometown to attend college. With the help of a student loan, he was able to establish his first barbershop. Today, nearly ten years later, he has expanded his business to include seven additional barbershops and a barber college, providing employment for almost 30 people.

“I started cutting hair when I was 19 years old,” he told Kark. “I barbered for two years and then I opened my own barbershop. “

When Arlo Washington applied for a student loan, he didn’t have any financial education. He only learned about finance through his entrepreneurial ventures. However, he soon realized that there were many others like him who lacked basic financial knowledge.

This became evident when the last Payday lending shop in Arkansas closed, and people began flooding the Barber College seeking loans. Using the $1,000 in monthly savings he set aside from his barber college profits, Washington began offering low-interest, small-dollar loans to those in need. This “table-top” loan disbursement system eventually evolved into the People Trust Community Loan Fund, which inspired him to establish a credit union that allowed loan fund customers to open savings accounts.

Washington eventually founded the People Trust Community Federal Credit Union, which in 2022 became one of only four new credit unions chartered in the US. Based in North Little Rock, Arkansas, it offers full-service banking to low and moderate-income communities, providing access to capital. With over 5,000 customers, the credit union has already provided loans to more than 2,600 small businesses.

According to a report from Talk Business, People Trust aims to challenge the disparity in access to financial services for minorities. The credit union’s primary goal is to eliminate economic barriers and provide easy access to financial opportunities for underserved and underbanked individuals. Arlo Washington believes that providing equal access to financial services for minorities will ultimately empower the entire community.

To mark the grand launch of People Trust, Washington offered the first 100 people to open an account with a $100 deposit. The credit union provides a range of services, including new and used auto loans, personal loans, checking and savings accounts, credit cards, and Certificates of Deposits (CDs).

In a press statement, People Trust stated that its objective is to close the racial gap of economic inequality in underserved communities and overlooked populations who often face barriers at traditional financial institutions.